1. GENERAL ELECTION MANIFESTOS MUST ADDRESS HOMELESSNESS AND HUNGER.

The 2012 and 2016 Welfare Reform Acts were seen through Parliament by

government ministers who sought to force the unemployed into work by

imposing inadequate incomes and punitive laws designed to treat them as

if they are at work.

Examples are:

- a monthly rather than a weekly income;

- housing benefit paid to the unemployed from which they pay the rent to the landlord as if it were from a monthly pay cheque; and

- strict rules about keeping appointments at the job centre.

The

purpose was to “change the culture” of unemployment, on the mistaken

assumption that the unemployed lived an easy life on benefits so were

unlikely to look for work, hence the cruel benefit sanction on those who

“broke the rules”.

“ Every

year I stand here because there is a forecast that says that child

poverty is going up, has gone up or will go up, but when we actually see

the figures, we find that child poverty has actually gone down. When

you transform the economy, change the culture so that work is what has

been driving things, and move up the employment rates and the earning

rates in the way that we have, you find that the behavioural impacts are

very different from the static analysis that many of the external

experts tell us about.”

Lord Freud could not have been more wrong. Child poverty is going up and getting worse.

Attempts

by cross-bench peers to insert amendments requiring a health-impact

assessment of the government’s policies were rejected. The actual and

disastrous impact on the health of low-income families and individuals

can be found on the Taxpayers Against Poverty website.

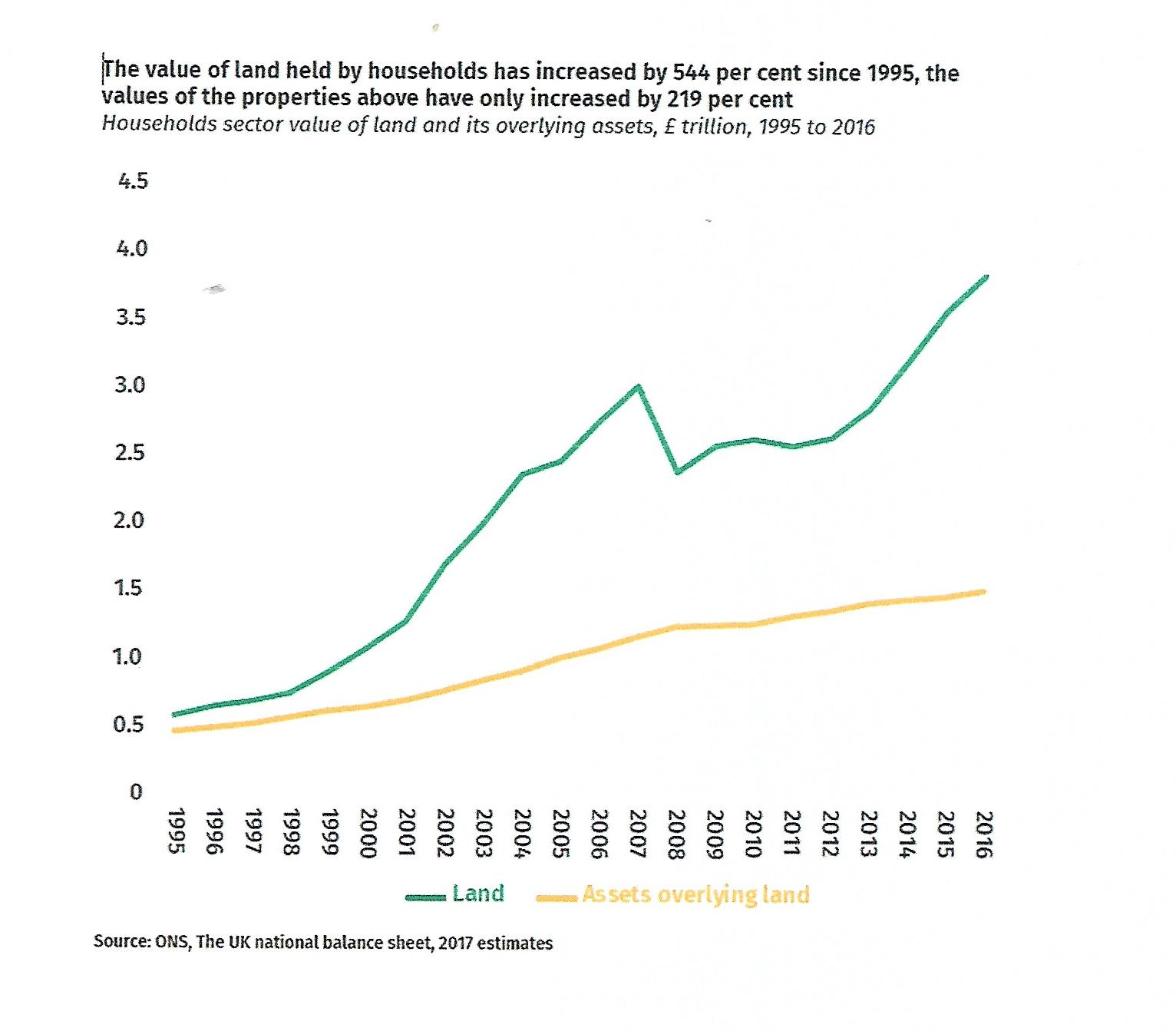

UK land grabbed by the rich for private gain

London

councils have published analysis showing that there has been a

significant reduction of about 200,000 in the number of homes that are

affordable for tenants receiving the Local Housing Allowance. That is

one among a number causes of the escalating homelessness and hunger in

the capital.

The

1980s’ “big bang” set up the UK housing market to make large landowners

very rich indeed, with unearned and untaxed increases in the value of

their land. Lending was deregulated, rent controls abolished and funds

allowed to flow in and out of the limited amount of British land. Small

businesses and family homes, which pay rent, business rates and/or

council tax, and own no land, are treated little better than during

the 15th- and 16th-century enclosures.

Tenants are being pushed off the land with no solutions on the political table to reverse the trend.

In

Haringey, 3,000 homeless families, with 5,208 children between them,

have been forced into temporary accommodation, some for up to and over

10 years. Accirding to the House of Commons Library

there are 83,700 homless families in temporary accommodation in England

with 124,000 children, up 74% sine 2010. 56,880 of the families are in

London. Too many of them are in one room in hostels or other

acommodation when none ought to be

|

| Graph from IPPR (Institute for Public Policy Research) |

Taxpayers Against Poverty strongly recommends that the Greater London Authority and Parliament adopt two policies used by the Danish government:

- Long-term vacancy of properties is discouraged in Denmark. If

an owner moves and does not wish to sell the property, it must be

rented out or advertised for sale. If it is empty for more than six

weeks, the owner must report to the local authority, which then seeks to

provide tenants, whom the owner has to accept.

- Non-residents of Denmark who have not lived in the country

for a total period of five years previously may only acquire property

after receiving permission from the Ministry of Justice.

Income support for a single adult has been losing value since 1979

There

is a community of about 11,000 social-security claimants in Haringey.

The shredding of their social security incomes since 2010 has been piled

on top of decades of adult benefit negligence. The evidence came from Professor Jonathan Bradshaw in 2009 responding

to one of mine. In April 2011, austerity measures were then piled onto

an already inadequate cornerstone of the benefit system. To that

cornerstone are added disabled people’s, children’s, housing and

council-tax benefits.

“When

unemployment benefit started in 1912, it was 7 shillings a week – about

22% of average male earnings in manufacturing. The percentage

fluctuated over the succeeding decades, but by 1979, the benefit rate

was still about 21% of average earnings (manual and non-manual, male and

female). By 2008, however, as a result of the policy of tying benefits

to the price index while real earnings increased, the renamed

Jobseeker’s Allowance had fallen to an all-time low of 10.5% of average

earnings.”

Benefit

increases were frozen at 1% a year in April 2011. £73.10 a week

Jobseekers’ Allowance equates to £317 a month Universal Credit. Using

the Joseph Rowntree Foundation’s minimum-income standards for

single-adult benefits after rent and council tax as of April 2019, we

can see that Jobseekers’ Allowance and Universal Credit are nearly £32 a

week too low for healthy living.

And that is before

- the five-week delay in the first payment of Universal Credit;

- the Department for Work and Pensions “budgeting advance”

to cover that delay, which is a loan that has to be repaid out of 73.10 a

week;

- the cuts in council tax and housing benefits, which mean rent and council tax must also be paid out of that £73.10 a week;

- income is stopped by benefit sanctions, during which rent,

council tax and TV-licence arrears and other debts pile up; adding to

the impossibility of living on benefits;

- the realisation – often only belatedly at the job centre –

by a parent who has a third child that the government’s two-child

policy means they will be refused child benefit for their latest

offspring.

The

hopelessly inadequate single adult benefit cannot maintain a healthy

adult life, let alone pay rent or council tax, or their enforcement

costs. That is a cruel catch 22. If your children’s benefits pay the

rent, they are hungry, naked or cold; if you feed, clothe growing

children or keep them warm, then the family is evicted and homeless.

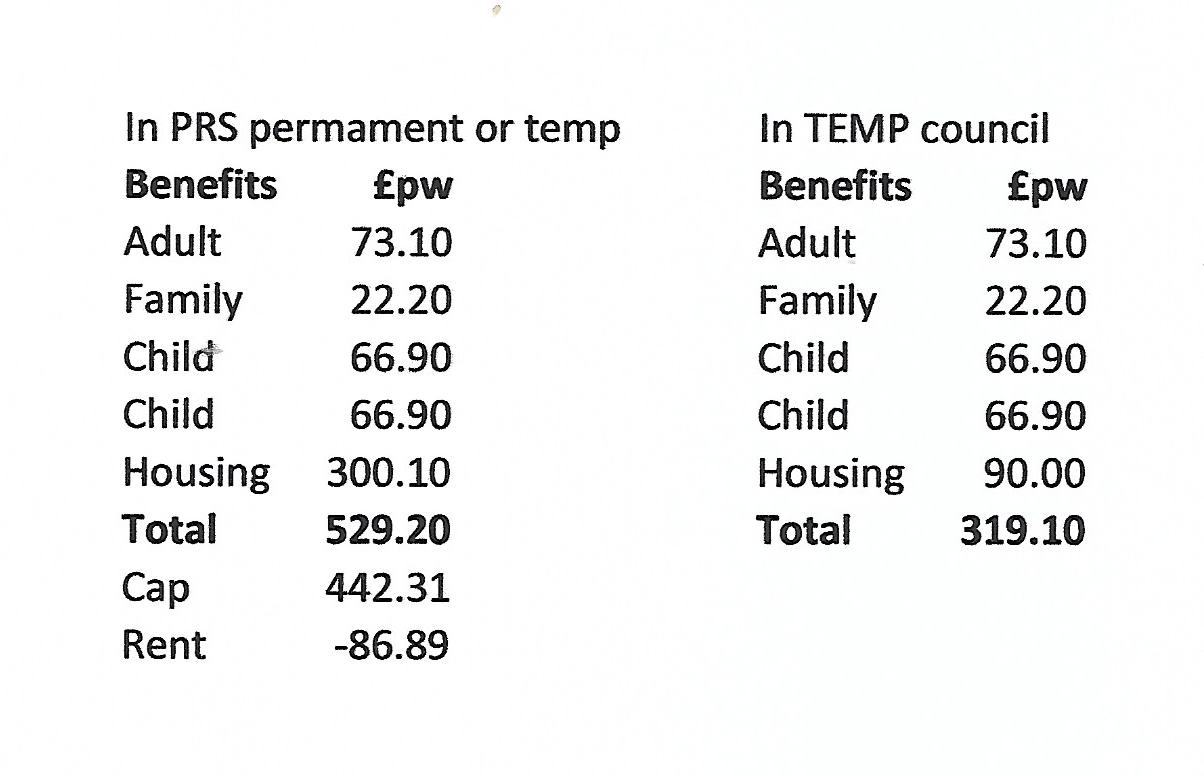

Low-income tenants forced into the benefit cap

In

the United Kingdom, local authority officers and benefit claimants are

both the victims of toxic and disconnected central government policies

that combine to escalate the number of homeless and hungry families. The

benefits freeze is bad enough (Benefits freeze leaves a third of claimants ‘with £100 to live on a month’), but,

in 2012, the government introduced another measure that is particularly

hard on London families. It allows local-authority housing departments

to offer homeless families in temporary council housing at £90 a week

rent a move into permanent private-sector housing at £300 a week rent

for a two-bed home, for example (see table).

Families

must accept the council’s first offer or they are deemed intentionally

homeless and struck off the list of those the council has a duty to

house. The unintended consequence of the 2012 measure is that

a family’s total benefit income, including housing benefit, can be

forced over the London benefit cap of £442.31 by high private-sector

rent. The government cuts the housing benefit to enforce the cap on the

total benefit income, leaving that rent to be paid by the family’s

remaining benefits, which have been frozen and are already short of £100

a month to live on. Hunger and homelessness are inevitable.

UK is the only nation in the world requiring renters to pay the landlord’s property tax.

The

UK being the only nation in the world requiring renters to pay the

landlord’s property tax adds the straw that breaks the camels back. That

is a great injustice. The council tax is a property tax based on 1991

evaluations after the poll tax was abolished and the council tax

introduced.

There

is a tenant of my acquaintance who lives in a private two-bed terraced

house in Tottenham that was bought new for £95,000 in 1999. An identical

property next door, also new in 1999, is on the market for £425,000.

The landlord is £330,000 richer, unearned and untaxed, while the tenant

has paid about £1,000 a year in property/council tax for 20 years, so is

£20,000 poorer.

290

out of 326 English councils require benefit claimants to pay a

proportion of their landlord’s council tax. It is enforced by the

magistrate’s court, adding the council’s enforcement costs to the

arrears and the bailiffs adding their fees. Taxing £73.10 a week income

support/Jobseekers’ Allowance/Universal Credit is a pernicious

injustice.

The good health and wellbeing of all UK citizens in or out of work must now become a national priority.

Taxpayers Against Poverty

A VOICE FOR THE COMPASSIONATE MAJORITY

No citizen without an affordable home and an

adequate income in work or unemployment.

TAP DEPENDS ON SUPPORTERS - PLEASE CONSIDER

|

No comments:

Post a Comment